Diversify Your Portfolio

Yield farming has taken hold in the DeFi world since 2020. It puts crypto assets to work and generates rewards for you. Aperture Finance helps you extend your investment into the DeFi space.

Focus on DeFi

Aperture Finance has focused on DeFi and actively participated in community projects since 2020. Ultra high returns only happen at the early adopter stage, we help you enjoy the first mover advantage.

Cutting-edge Technology

All star team based in Silicon Valley with product and engineering expertise from Google, Amazon Web Services (AWS) and Netflix. Founding members are graduates from Stanford University, Columbia University, Cornell University and UC Berkeley.

How this works

In order to explain how this works, we will first cover several fundamental concepts.

De-Fi

Decentralized Finance

Stablecoin

Digital currency designed to peg to a “stable” reserve asset

Yield Farming

Liquidity Mining

De-Fi

Decentralized FinanceDeFi stands for “Decentralized Finance”. It is “a system by which financial products become available on a public decentralized blockchain network, making them open to anyone to use”1, geared towards disrupting financial intermediaries such as banks or brokerages.

It is the backdrop of the stage, and stablecoins are the main players.

Yield Farming

Yield farming, also referred to as liquidity mining, is the practice of generating high returns by providing liquidity to facilitate transactions with your crypto holdings.

Popular yield farming protocols include Aave, Compound, and Uniswap.

Stablecoin

Unlike tokens such as Bitcoin, Ethereum and Dogecoin, a stablecoin is a digital currency that is designed to peg to a “stable” reserve asset like the U.S. dollar.

There are several types of stablecoins, such as fiat-backed, crypto-collateralized, and algorithmic stablecoins. Popular ones include USDT, USDC, DAI and UST and they all maintain a 1:1 ratio to the U.S. dollar (read more).

Dai

Yearn Finanace

Loopring

Zrx

Aave

Dai

Yearn Finanace

Loopring

Zrx

Aave

Dai

Yearn Finanace

Loopring

Zrx

Aave

Dai

Yearn Finanace

Loopring

Zrx

Aave

Maker

Uma

Chainlink

Bitcoin

Compound

Maker

Uma

Chainlink

Bitcoin

Compound

Maker

Uma

Chainlink

Bitcoin

Compound

Maker

Uma

Chainlink

Bitcoin

Compound

Uniswap

Knc

Synthetix Network

Ren

Avalanche

Uniswap

Knc

Synthetix Network

Ren

Avalanche

Uniswap

Knc

Synthetix Network

Ren

Avalanche

Uniswap

Knc

Synthetix Network

Ren

Avalanche

What We Do

Aperture Finance takes care of yield farming for you. We take fiat-currencies from the investors, convert the assets into stablecoins, and adopt a combination of yield-farming strategies, based on your risk profile, to generate outstanding returns for you.

Here is a list of passive and active strategies (ranked by the risk levels) our fund management team uses:

01.

Staking stablecoins (USDT, USDC, UST) on vetted protocols.

02.

Staking USDC-USDT-wUST tri-pair on Mercurial Finance.

03.

Simultaneous long-farm and short-farm on synthetic stock tokens with Mirror protocol with a Delta-neutral strategy minimize the volatility and loss caused by the fluctuations in the underlying asset price.

04.

Active liquidity farming with stablecoins and crypto pairs with Uniswap v3.

To learn more about the funds Aperture Finance has to offer, please visit this page.

What are the risks?

Assets deposited Aperture Finance are covered by an industry leading coverage policy. Aperture Finance invests adopts algorithms to actively invest on behalf of the investors, as well as lend assets deposited onto Aperture Finance to heavily vetted institutions.

Please note that digital currency is not legal tender, is not backed by the government, and is not subject to FDIC or SIPC protections. This is not a risk-free product.

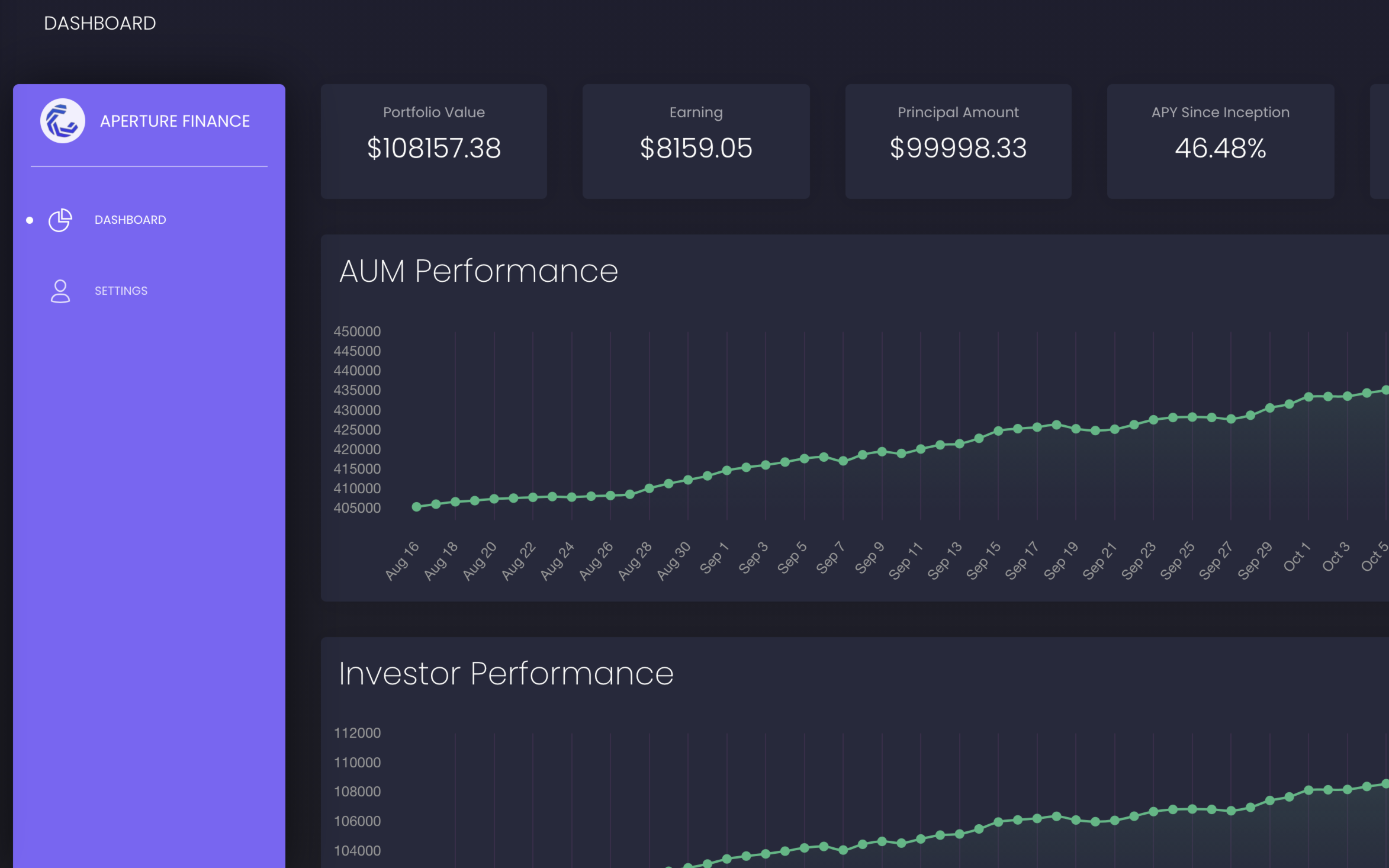

Performance

This is the performance of the pilot fund launched on 08/02/2021.

Assets Under Management

Cumulative Return

Rolling 7-day APR

101.55%

Rolling 7-day APY

173.38%

Avg. APR since Inception

50.59%

Avg. APY since Inception

62.32%

Past performance is no guarantee of future results.

Funds Available

For more information, please contact: contact@aperture.finance

Portfolio Strategy

aggresive

Active investment on synthetic stock tokens with simultaneous long-farm and short-farm to create a Delta-neutral portfolio, dynamic yield-farming and seeking arbitrage opportunities, aiming to provide the highest returns. The lock-up period is 6 months.

balanced

Dynamic allocation of stable coins and actively migrate to protocols with higher APRs. The lock-up period is 6 months.

conservative

Passive portfolio of stable coins on audited protocols with consistent APRs. Flexible exits.

about

Founded in 2020, Aperture Finance is a startup based in the Silicon Valley with a focus on DeFi investment and protocol development. Aperture Finance adopts active strategies to provide the higher yields than conventional yield aggregators and develops smart contracts to scale and manage risks.

Lian Zhu

Co-Founder

Lian Zhu is a Senior Product Manager at AWS. He has over 10 years’ product management, having worked for Amazon Kindle and Netflix, owning the localization strategy as the voice of the product in the Greater China Region.

He is the Founder and CEO of Internest Inc. Lian is also an EMBA graduate candidate at UC Berkeley Haas. He has extensive experience in investing in the crypto and DeFi space.

Peiqian Li

Co-Founder

Peiqian Li is a Senior Software Engineer at Google, with 6 years’ experience in recommender systems and Deep Learning. He obtained his MSc. and BSc. in Computer Science from Stanford University and Columbia University.

He is a medalist in both the National Olympiad in Informatics (NOI) and ACM ICPC. Peiqian has a profound understanding of blockchain design and application. His current focus is Smart Contract development.

Gao Han

Co-Founder

Gao Han is a Senior Software Engineer at Google with a focus on machine learning and Big Data. Having worked as Software Engineer at AWS, he is well versed with system and infrastructure design.

He earned his BSc in Computer Science at Cornell University and was part of a Harvard University research team on the Connectome Project for human brain neuron mapping. He has been focusing on the DeFi space and is exploring arbitrage opportunities.